The Ultimate Guide To Feie Calculator

Everything about Feie Calculator

Table of ContentsAn Unbiased View of Feie CalculatorIndicators on Feie Calculator You Should KnowFeie Calculator - TruthsThe Feie Calculator PDFsFascination About Feie Calculator

He sold his United state home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his wife to assist meet the Bona Fide Residency Test. Neil directs out that purchasing residential property abroad can be challenging without first experiencing the place."We'll certainly be outdoors of that. Even if we return to the US for physician's appointments or business phone calls, I question we'll spend greater than one month in the United States in any kind of offered 12-month period." Neil emphasizes the value of stringent tracking of united state visits (Taxes for American Expats). "It's something that individuals require to be actually attentive concerning," he says, and suggests expats to be mindful of common blunders, such as overstaying in the united state

Feie Calculator Things To Know Before You Get This

tax obligation commitments. "The factor why united state taxation on worldwide earnings is such a big offer is because many individuals forget they're still subject to united state tax also after moving." The united state is one of the couple of countries that taxes its people regardless of where they live, meaning that even if an expat has no income from united state

tax return. "The Foreign Tax obligation Credit history permits people operating in high-tax countries like the UK to offset their U.S. tax obligation responsibility by the amount they've already paid in taxes abroad," says Lewis. This ensures that expats are not tired two times on the same revenue. However, those in low- or no-tax nations, such as the UAE or Singapore, face additional obstacles.

Feie Calculator for Beginners

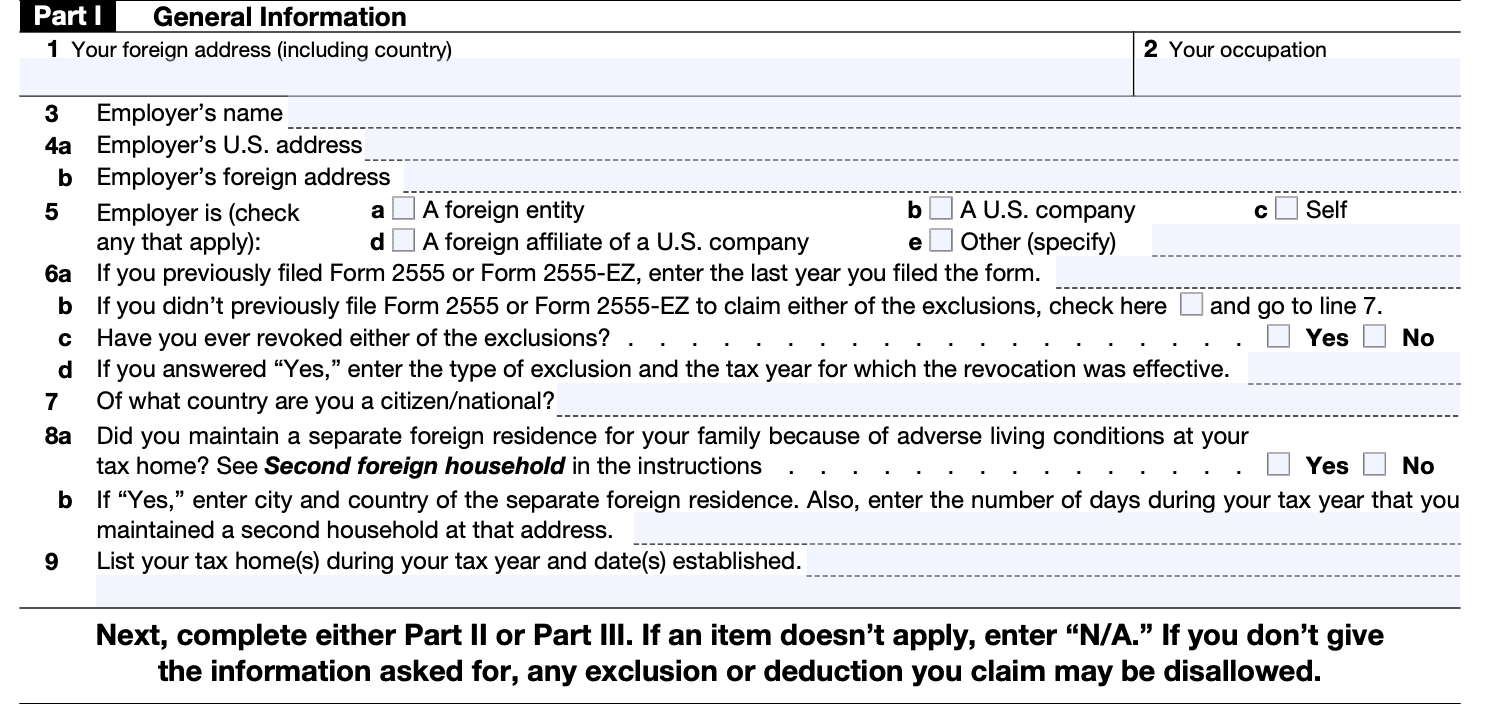

Below are several of one of the most regularly asked questions concerning the FEIE and other exclusions The Foreign Earned Income Exemption (FEIE) permits U.S. taxpayers to omit approximately $130,000 of foreign-earned revenue from government earnings tax obligation, minimizing their U.S. tax obligation liability. To qualify for FEIE, you need to satisfy either the Physical Existence Examination (330 days abroad) or the Bona Fide Residence Examination (confirm your primary house in a foreign country for a whole tax year).

The Physical Visibility Test additionally requires U.S (Physical Presence Test for FEIE). taxpayers to have both a foreign earnings and a foreign tax home.

The Ultimate Guide To Feie Calculator

An earnings tax obligation treaty in between the united state and an additional nation can aid prevent dual tax. While the Foreign Earned Earnings Exemption minimizes taxable income, a treaty may supply fringe benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Report) is a required declare U.S. residents with over $10,000 in foreign monetary accounts.

Eligibility for FEIE depends upon conference details residency or physical presence examinations. is a tax consultant on the Harness system and the owner of Chessis Tax. He belongs to the National Organization of Enrolled Agents, the Texas Culture of Enrolled Professionals, and the Texas Culture of CPAs. He brings over a years of experience working for Huge 4 firms, encouraging expatriates and high-net-worth people.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation consultant on the Harness system and the founder of The Tax Dude. He has over thirty years of experience and currently focuses on CFO services, equity settlement, copyright tax, cannabis tax and separation associated tax/financial preparation matters. He is a deportee based in Mexico - https://medium.com/@louisbarnes09/about.

The international earned earnings exclusions, sometimes referred to as the Sec. 911 exclusions, exclude tax obligation on incomes earned from working abroad. The exclusions comprise 2 components - an income exclusion and a housing exclusion. The complying with Frequently asked questions talk about the benefit of the exclusions consisting of when both spouses are expats in a general fashion.

The Main Principles Of Feie Calculator

The tax advantage excludes the earnings from tax obligation at lower tax obligation rates. Formerly, the exemptions "came off the top" minimizing income subject to tax at the top tax obligation prices.

These exclusions do not exempt the salaries from United States tax but simply supply a tax obligation decrease. Note that a bachelor Homepage functioning abroad for every one of 2025 that earned regarding $145,000 without any other income will certainly have taxable income minimized to zero - efficiently the exact same solution as being "tax complimentary." The exclusions are computed every day.